Este artículo también está disponible en español.

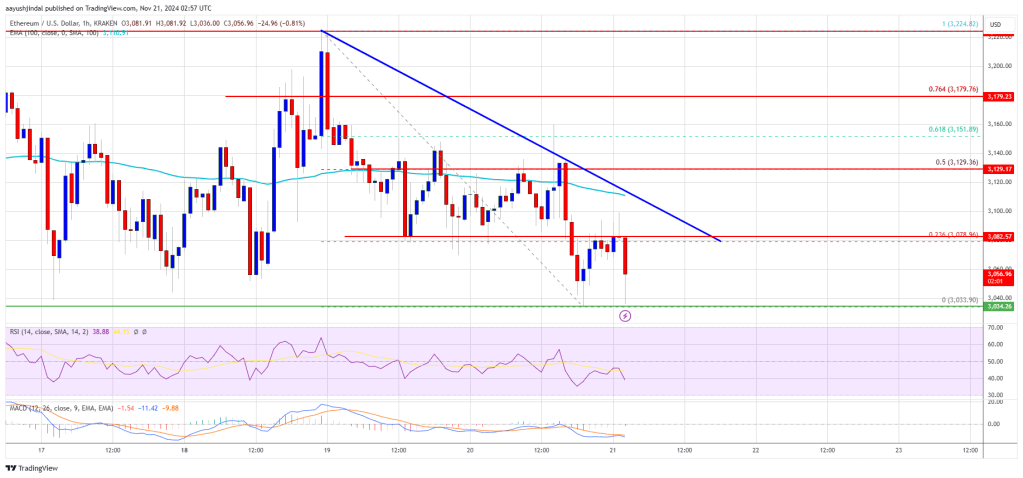

Ethereum price started another decline below the $3,150 zone. ETH is struggling and might decline further below the $3,000 support zone.

- Ethereum is slowly moving lower below the $3,150 zone.

- The price is trading below $3,100 and the 100-hourly Simple Moving Average.

- There is a connecting bearish trend line forming with resistance at $3,080 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could extend losses if there is a close below the $3,000 support zone.

Ethereum Price Struggle Continues

Ethereum price attempted an upside break above the $3,200 resistance but failed unlike Bitcoin. ETH started a fresh decline below the $3,150 and $3,120 support levels.

There was a move below $3,080 and the price tested $3,040. A low is formed at $3,033 and the price is now consolidating. It tested the 23.6% Fib retracement level of the recent drop from the $3,225 swing high to the $3,033 low.

Ethereum price is now trading below $3,000 and the 100-hourly Simple Moving Average. On the upside, the price seems to be facing hurdles near the $3,080 level.

The first major resistance is near the $3,120 level or the 50% Fib retracement level of the recent drop from the $3,225 swing high to the $3,033 low. The main resistance is now forming near $3,180. A clear move above the $3,180 resistance might send the price toward the $3,220 resistance.

An upside break above the $3,220 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $3,450 resistance zone.

More Losses In ETH?

If Ethereum fails to clear the $3,100 resistance, it could start another decline. Initial support on the downside is near the $3,030 level. The first major support sits near the $3,000 zone.

A clear move below the $3,000 support might push the price toward $2,920. Any more losses might send the price toward the $2,880 support level in the near term. The next key support sits at $2,740.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bearish zone.

Hourly RSI – The RSI for ETH/USD is now below the 50 zone.

Major Support Level – $3,030

Major Resistance Level – $3,100