Chainlink (LINK) is experiencing significant growth in the cryptocurrency sector, with a 20% increase in value in just one week and a potential change in its long-term trajectory.

For months, the cryptocurrency has been on a downward trajectory; however, it is currently exhibiting significant signs of recovery. The next significant level for LINK is $17, and investors and experts are closely monitoring the stock.

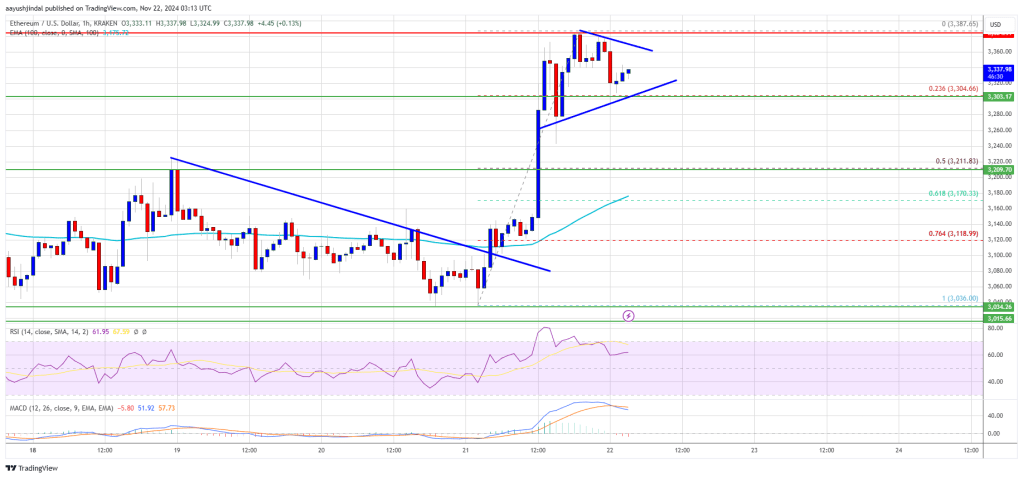

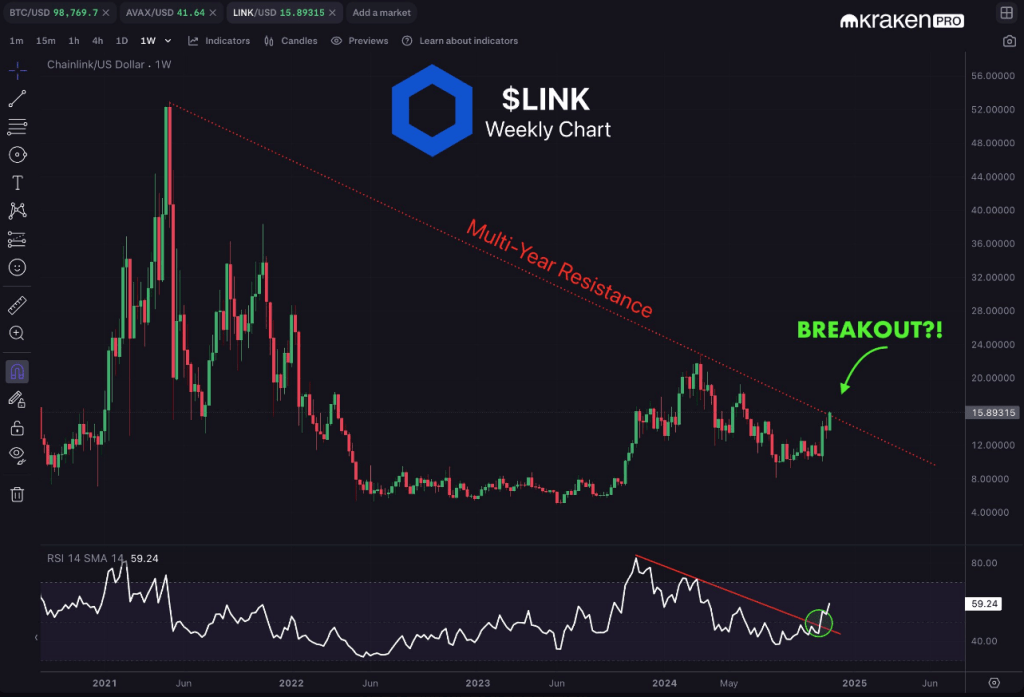

Chainlink has begun to draw the attention of both institutional and retail investors after breaking out of a falling channel and passing key exponential moving averages. This technical breakout could pave the way for even larger gains.

Whale Activity Increases Confidence

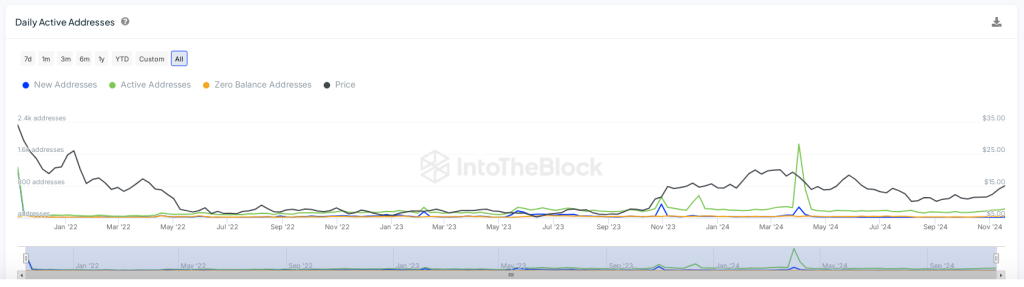

Activity from whales has been one of the prime movers for the upward momentum currently being seen in LINK. As IntoTheBlock would have it, large LINK transactions have jumped 8.56% in the last 24 hours. The spike suggests that large players are very bullish, and it is not something that has gone unnoticed.

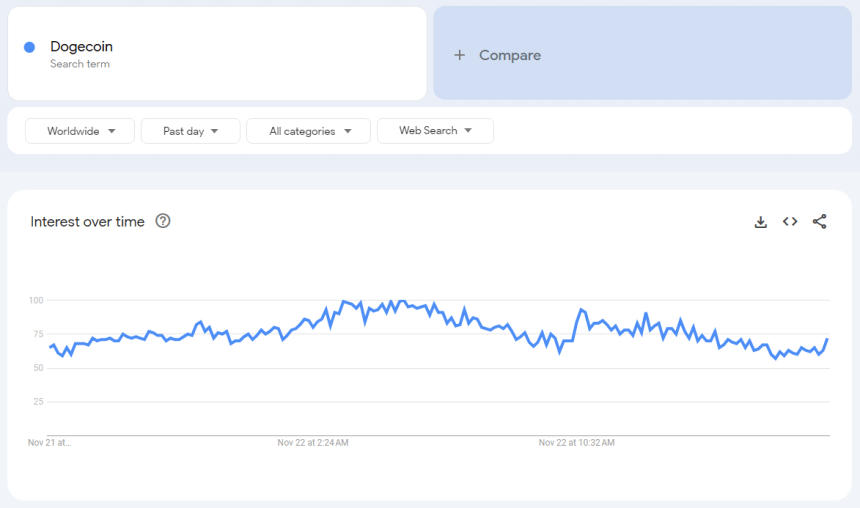

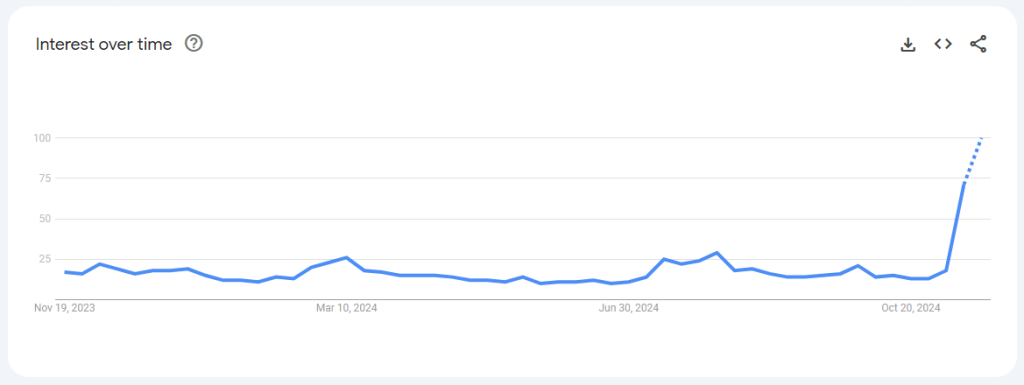

Retail interest is also increasing, with a 2.10% increase in new addresses and a 1.09% gain in daily active users. Chainlink is trending on social media, according to Santiment’s research, with its sentiment and weight metrics showing a 0.28% jump. Investors are talking, and the chatter is fueling LINK’s upward march.

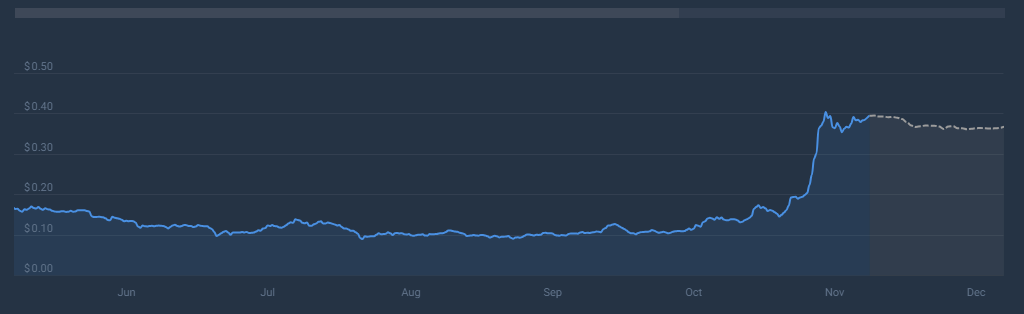

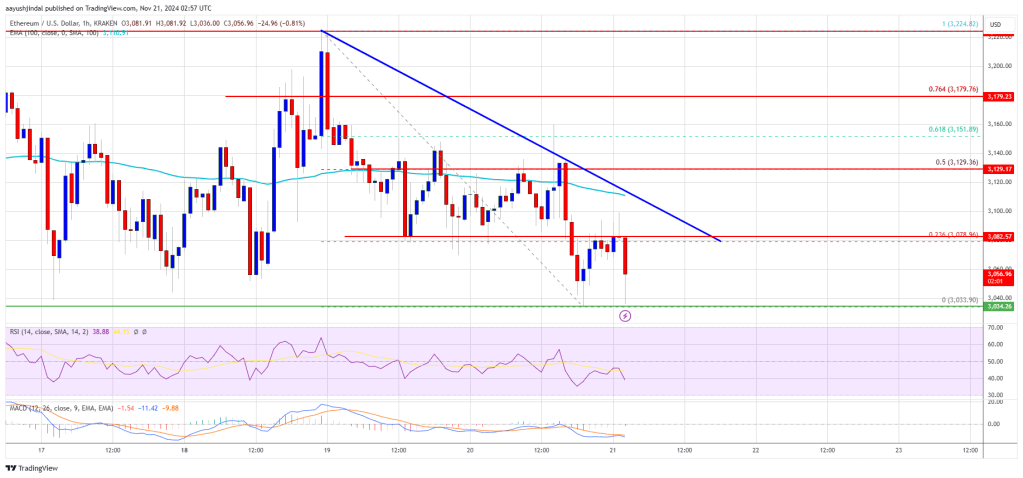

LINK Price Action

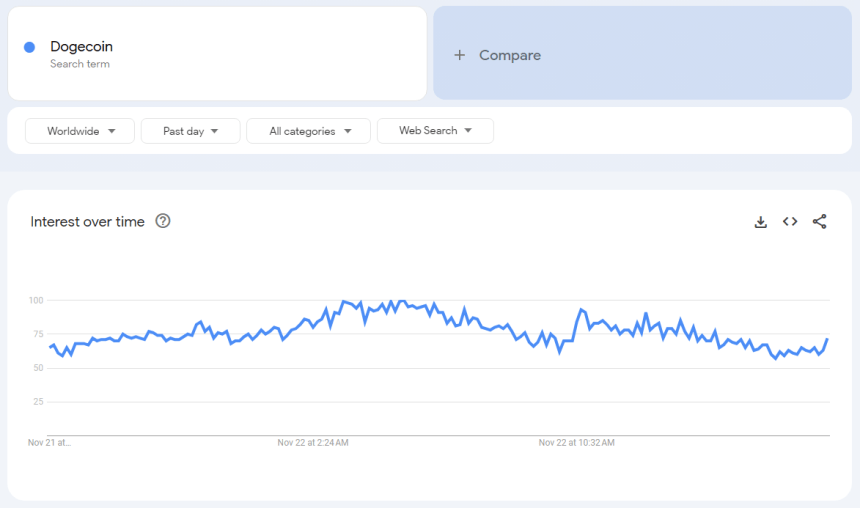

Presently, at a price of $16.94, Chainlink is up by 11% in the last 24 hours, getting ready to take the next leap and break above the $17.12 resistance barrier. Analysts believe that if this surpasses the specified barrier, the path to $30 will become more likely. Some predict that continued momentum may facilitate a retest of LINK’s all-time high of $52.88, achieved in May 2021.

The cryptocurrency market as a whole is experiencing a bullish November, with Bitcoin remaining above $98,000. This broader confidence is boosting Chainlink’s potential, but it still needs to catch up to prior highs.

#Chainlink

is attempting to break the multi-year resistance. Potentially entering a bullish expansion phase. + Weekly RSI breakout confirmed. $LINK#Crypto $Alts

pic.twitter.com/Efm0dE9KfZ

— Kevin Svenson (@KevinSvenson_) November 22, 2024

A Rally In The Making

Coinglass data shows a rise in Chainlink’s futures traded, which suggests traders’ growing curiosity and confidence. Additionally exploding open interest in LINK will help to support the positive story. Although technical indicators and market mood forecast future, reaching a new all-time high would need constant market confidence and suitable conditions.

Chainlink is riding a current of optimism at the moment, driven by whale activity and growing retail interest. If it can continue in this trajectory and break through key resistance levels, LINK might be able to surprise everyone and restore its old glory.

Featured image from DALL-E, chart from TradingView