Este artículo también está disponible en español.

The price of XRP has surpassed $1, a significant milestone that has not been observed since December 2021. The cryptocurrency’s market capitalization increased by $20 billion to approximately $64 billion on November 17, when it reached $1.23. This surge has incited a frenzy of discourse within the cryptocurrency community; however, it is not solely the price that is garnering attention.

Related Reading

The Pot Is Being Stirred By Rumors Of A Meeting With Trump

Most of the conjecture about XRP’s surge stems from unsubstantiated accounts that Ripple CEO Brad Garlinghouse met with President-elect Donald Trump. Though neither Garlinghouse nor Trump’s staff have confirmed or refuted the meeting, the rumors have spurred discussions across the sector.

Brad Garlinghouse is shilling XRP and CBDC implementations. I am shilling American dynamism, and smart appointments that will solidify Trump’s legacy. We are not the same.

— Ryan Selkis (d/acc) 🇺🇸 (@twobitidiot) November 16, 2024

Some, such as former Messari CEO Ryan Selkis, have also gone public with the strongest term on record criticizing Ripple for the possibility of dictating US policy. Pierre Rochard of Riot Platforms and others have expressed skepticism about the anti-Bitcoin posture of Ripple and how it could be damaging for the future regarding crypto regulation.

We can’t let Ripple co-opt the United States policymaking process with their anti-bitcoin agenda.

Hopefully Trump will staff his Administration with more bitcoiners!

— Pierre Rochard (@BitcoinPierre) November 16, 2024

Garlinghouse has expressed confidence in the potential beneficial effects of the Trump administration on the cryptocurrency sector, despite the controversy. Garlinghouse suggested in a recent appearance on Fox Business that Trump perceives the crypto industry as a potential source of innovation and entrepreneurship.

🚨BREAKING: CEO of @Ripple – Brad Garlinghouse on FOX NEWS!

Donald Trump had a meeting with Ripple. 👀

💥 #XRP WILL MELT FACES 💥 pic.twitter.com/qp6CMbRTdY

— JackTheRippler ©️ (@RippleXrpie) November 15, 2024

His remarks, which center on the activities of SEC Chairman Gary Gensler, are perceived as directly addressing the regulatory obstacles presently affecting Ripple. This has strengthened the belief that, should government change, more favorable conditions could exist for crypto activities running within the United States.

Whale Activity And Bullish Sentiment Drive The Rise Of XRP

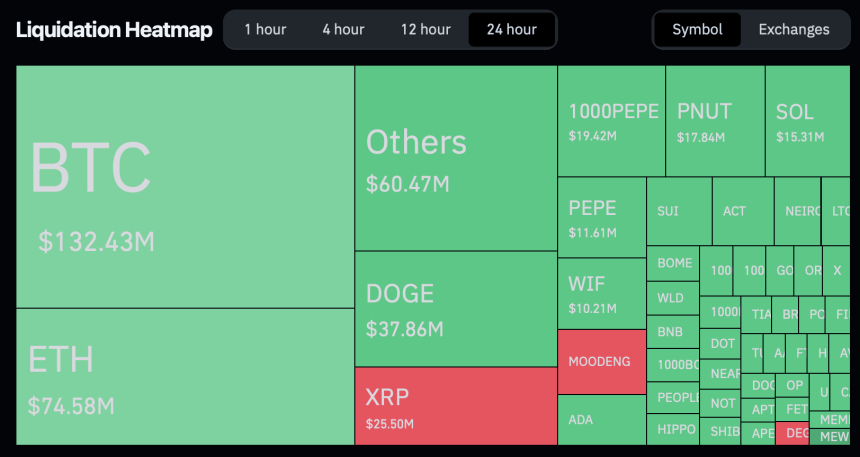

The rise of XRP is not solely due to speculative conjecture; it is substantiated by robust market data. Whale activity has been increasing, as evidenced by reports of substantial XRP transfers exceeding $316 million in the span of two days.

Their action might be the decisive step for a price rise, as such large-scale transactions typically indicate the big holders’ positive mood. Secondly, the Relative Strength Index indicates that XRP is in the boundary of an overbought area; in other words, the surge has already reached its maximum. However, the level of hope is rather high, and most people think that the trend will continue.

Related Reading

Looking Ahead: Institutional Interest And ETF Prospects

In addition to the optimism, there are increasing expectations that an XRP exchange-traded fund (ETF) may be in the works. This, in conjunction with the increasing institutional interest in Ripple’s native token, could be a further catalyst for the sustained growth of XRP.

XRP is currently trading at $1.16, making it the best-performing cryptocurrency in the top 10 by market capitalization. Investors are eager to observe its future trajectory. Ripple’s future is unquestionably attracting significant attention, regardless of whether the rumors regarding a Trump meeting are accurate.

Featured image from Techreport, chart from TradingView