Este artículo también está disponible en español.

A crypto analyst, identified as ‘Trading Jesus’ on X (formerly Twitter), unveiled the roadmap for the Dogecoin price to reach $1. By highlighting Dogecoin’s resistance and support levels, the analyst has underscored the major hindrance to the meme coin hitting the $1 milestone.

Dogecoin Price Roadmap To The $1 Target

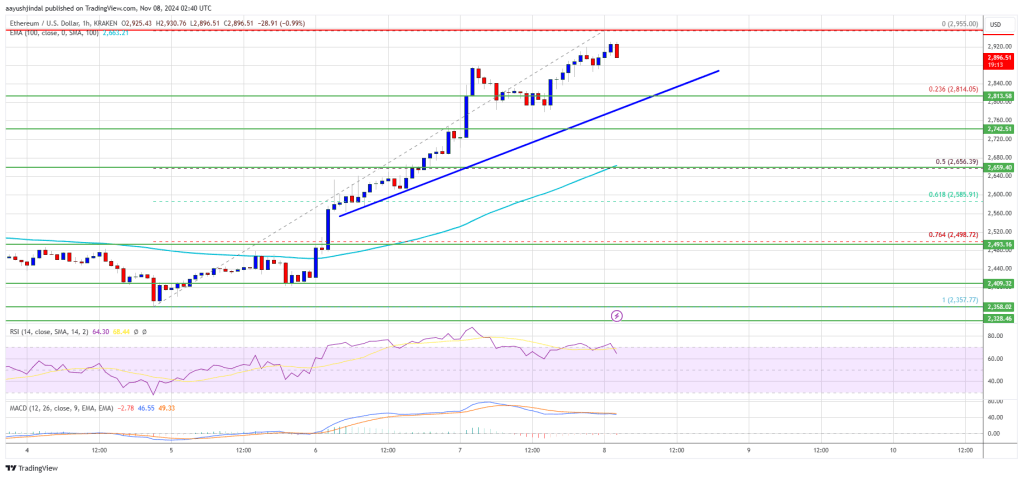

In his X post, Trading Jesus shared a Dogecoin chart on the 1-hour timeframe showing the support and resistance levels as the Dogecoin price aims for the $1 mark. Currently trading at $0.36, the crypto analyst has indicated that the next resistance level for Dogecoin is $0.44.

Related Reading

This crucial level could trigger major selling pressures for the meme coin as investors start liquidating their holdings. However, if Dogecoin can successfully break above the $0.44 level, the meme coin could enter a bullish phase, with its next price high at around $0.56.

Trading Jesus has highlighted the $0.56 price increase as a profit-taking level at which traders and investors could begin selling their Dogecoin for potential gains. The analyst has also pinpointed a higher resistance level at $0.73336 if Dogecoin can maintain its bullish momentum above that level.

At the $0.73336 resistance level, Trading Jesus has predicted that Dogecoin could see its price surging to the highly coveted $1 milestone. His chart revealed Dogecoin’s next bullish target to be $0.996 if its price continues increasing.

On the flip side, Trading Jesus has also shown the support levels for Dogecoin if it fails to break past key resistance levels. The first support at $0.34 represents a crucial level where buyers might step in if the price of Dogecoin drops. This support level ultimately acts as a barrier to prevent more price drops.

If Dogecoin declines below the $0.34 support level, the cryptocurrency could experience further downward pressure, leading to a drop towards the $0.25 mark. If more pullbacks occur, Trading Jesus has revealed that the Dogecoin price could bottom to new lows around the $0.18 level.

Analyst Remains Bullish Despite DOGE’s 8% Price Decline

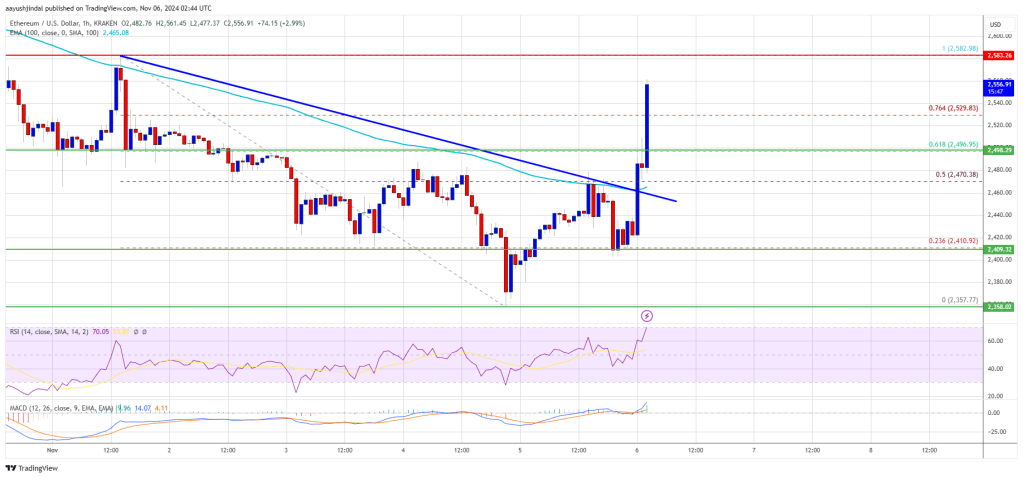

While analysts foresee the Dogecoin price hitting $1, others have predicted even higher all-time highs for the popular meme coin. A crypto analyst known as the ‘Cantonese Cat’ on X has unveiled a weekly DOGE price chart projecting a potential leap to $4.

Related Reading

In the chart, the analyst indicated that Dogecoin is on its way to hitting the $0.42 price level at the 0.786 Fibonacci level. Breaking past this level could trigger a surge towards the 1.618 Fib, representing a price increase above $4.0.

The Cantonese cat has revealed that investors and traders likely have three to four weeks to accumulate at Dogecoin’s current price of $0.36 before it shoots up to $4.

Featured image created with Dall.E, chart from Tradingview.com