Este artículo también está disponible en español.

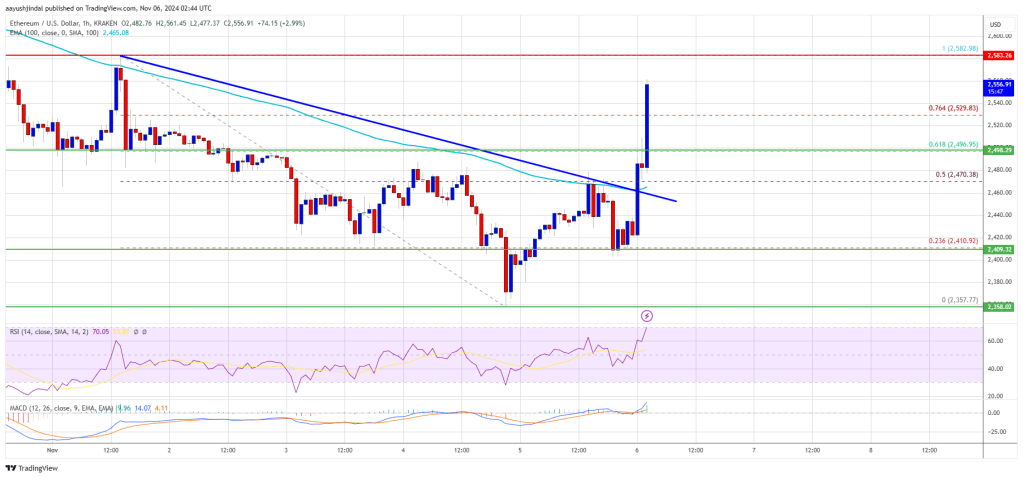

Ethereum price found support near $2,350 and started a fresh increase. ETH is rising and might aim for a move above the $2,580 resistance.

- Ethereum started a fresh surge above the $2,500 resistance zone.

- The price is trading above $2,500 and the 100-hourly Simple Moving Average.

- There was a break above a key bearish trend line with resistance at $2,460 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could gain bullish momentum if it settles above $2,580 and $2,620.

Ethereum Price Restarts Increase

Ethereum price found support near $2,350 and started a fresh increase like Bitcoin. ETH was able to climb above the $2,420 and $2,450 resistance levels to move into a positive zone.

It cleared the 50% Fib retracement level of the downward move from the $2,583 swing high to the $2,357 low. Besides, there was a break above a key bearish trend line with resistance at $2,460 on the hourly chart of ETH/USD.

Ethereum price is now trading above $2,500 and the 100-hourly Simple Moving Average. It is also above the 76.4% Fib retracement level of the downward move from the $2,583 swing high to the $2,357 low.

On the upside, the price seems to be facing hurdles near the $2,580 level. The first major resistance is near the $2,620 level. The main resistance is now forming near $2,650. A clear move above the $2,650 resistance might send the price toward the $2,720 resistance.

An upside break above the $2,720 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $2,750 resistance zone.

Another Drop In ETH?

If Ethereum fails to clear the $2,620 resistance, it could start another decline. Initial support on the downside is near the $2,520 level. The first major support sits near the $2,500 zone.

A clear move below the $2,500 support might push the price toward $2,450. Any more losses might send the price toward the $2,320 support level in the near term. The next key support sits at $2,350.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $2,450

Major Resistance Level – $2,620