Este artículo también está disponible en español.

Tim Robinson, Head of Crypto Research at BlueYard Capital, has unveiled groundbreaking simulations indicating that Ethereum’s implementation of “blobs” could be exceptionally bullish for the long-term price of ETH. In a series of posts on X, Robinson highlighted how blobs could revolutionize Ethereum’s scalability and economic dynamics.

“Many people arguing about blobs, but so far no one has simulated how they respond to demand… until now,” Robinson stated. “TL;DR: Blobs are insanely bullish for ETH long term.”

Why Blobs Are ‘Insanely Bullish’ For Ethereum Price

Blobs, introduced in Ethereum Improvement Proposal (EIP)-4844, are large data structures designed to enhance the network’s capacity by efficiently storing and processing data off-chain. This mechanism is pivotal for Layer 2 (L2) scaling solutions, enabling them to offer lower transaction fees while maintaining security through Ethereum’s consensus.

Related Reading

Robinson’s simulation projects Ethereum operating at 10,000 transactions per second (TPS), burning 6.5% of its total ETH supply annually, with L2 transactions costing an average of $0.06. This scenario involves 16 MB of blobs per block, aligning with Ethereum co-founder Vitalik Buterin’s medium-term goals outlined in his latest “The Surge” post.

“Yes, that’s Ethereum operating at 10k TPS, burning 6.5% a year while L2 transactions cost an average of $0.06, with 16 MB of blobs per block,” Robinson elaborated. “You thought L2’s were parasitic and Vitalik didn’t think this through? Ah, sweet summer child, little do you realize how insane this will get when the Ethereum ecosystem really kicks into high gear.”

A key insight from Robinson’s research is the rapid escalation of ETH burning as blob usage increases. “It’s interesting how quickly blobs go from being free to burning a ton of ETH. It seems almost everyone doesn’t understand this tipping point. It also makes me think there might be a better pricing mechanism,” he observed.

Robinson provides a simulation tool illustrating the ETH burn rate‘s exponential growth as TPS scales from the current ~180 TPS to 400 TPS. The data shows burned ETH increasing from roughly 4 ETH per day to 1,832 ETH per day.

It’s interesting how quickly blobs go from being free to burning a ton of ETH. It seems almost everyone doesn’t understand this tipping point. It also makes me think there might be a better pricing mechanism.

Here’s what it looks like increasing from today’s ~180TPS to 400TPS pic.twitter.com/fjuK19NL6y

— Tim Robinson (@timjrobinson) October 29, 2024

The scalability potential is further enhanced by the implementation of Peer Data Availability Sampling (PeerDAS), which allows blob capacity to scale with the number of validators. “Because total blob capacity scales with total validators, after PeerDAS is implemented, blobs can scale as high as needed,” Robinson explained. “There are 10k+ nodes to shard the load between them. While other ecosystems struggle under load, Ethereum will supply the world with cheap, abundant block-space while being extremely deflationary.”

Related Reading

An intriguing feedback loop identified by Robinson is the inverse relationship between ETH price and the burn rate. “Another interesting feedback loop is the lower the ETH price, the higher the burn! As transaction prices are lower, more transactions are made, and the burn soars,” he noted. “See how different the burn is with ETH at $2k vs ETH at $10k”.

Another interesting feedback loop is the lower the ETH price, the higher the burn! As transaction prices are lower, more transactions are made, and the burn soars. See how different the burn is with ETH at $2k vs ETH at $10k: pic.twitter.com/tbSbC6unwM

— Tim Robinson (@timjrobinson) October 29, 2024

Addressing the question of value accrual for ETH, Robinson stated, “So how will ETH accrue value? Being the most useful, scarce, deflationary asset with 10,000+ teams using Ethereum to grow their products will probably do it. Long term, ETH has the best fundamentals in the world; it just takes time for them to play out.”

The research sparked enthusiasm and discussions within the ETH community. Mat (@materkel) commented on X: “Will be extremely interesting once we hit blob capacity. My guess is a lot of L2s still need to figure out how to handle this case and properly fee their users. There will be a lot of inefficiencies to fix; we just didn’t really have multiple competing L2s in this scenario before. Once the dust settles, we’ll have proper price discovery both for fees on L2s together with blobs on L1.”

Robinson responded, emphasizing the importance of proactive analysis: “Yeah, absolutely! I’m trying to bring the data so we can solve any problems before we get there. The market becomes more stable with more blobs, but in the early days, fees could be quite volatile.”

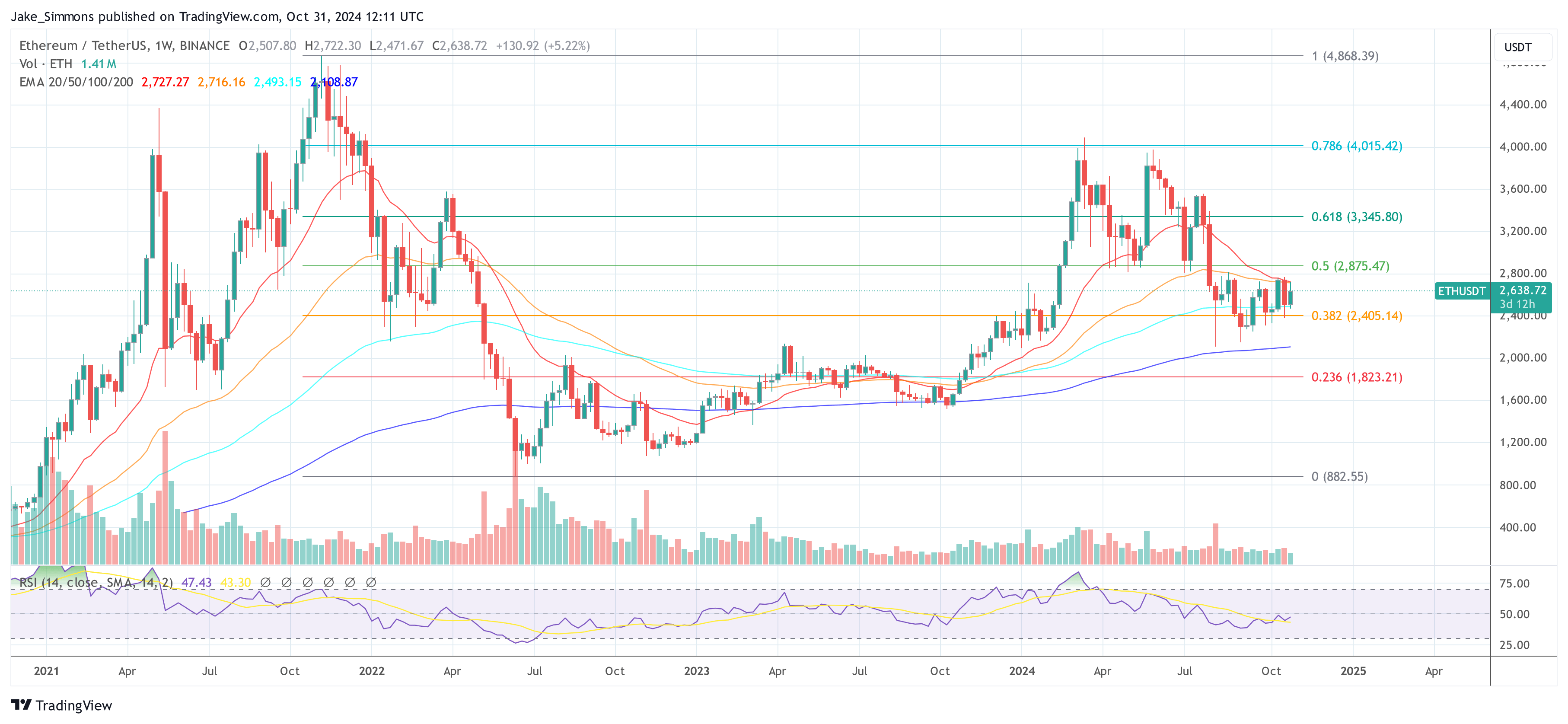

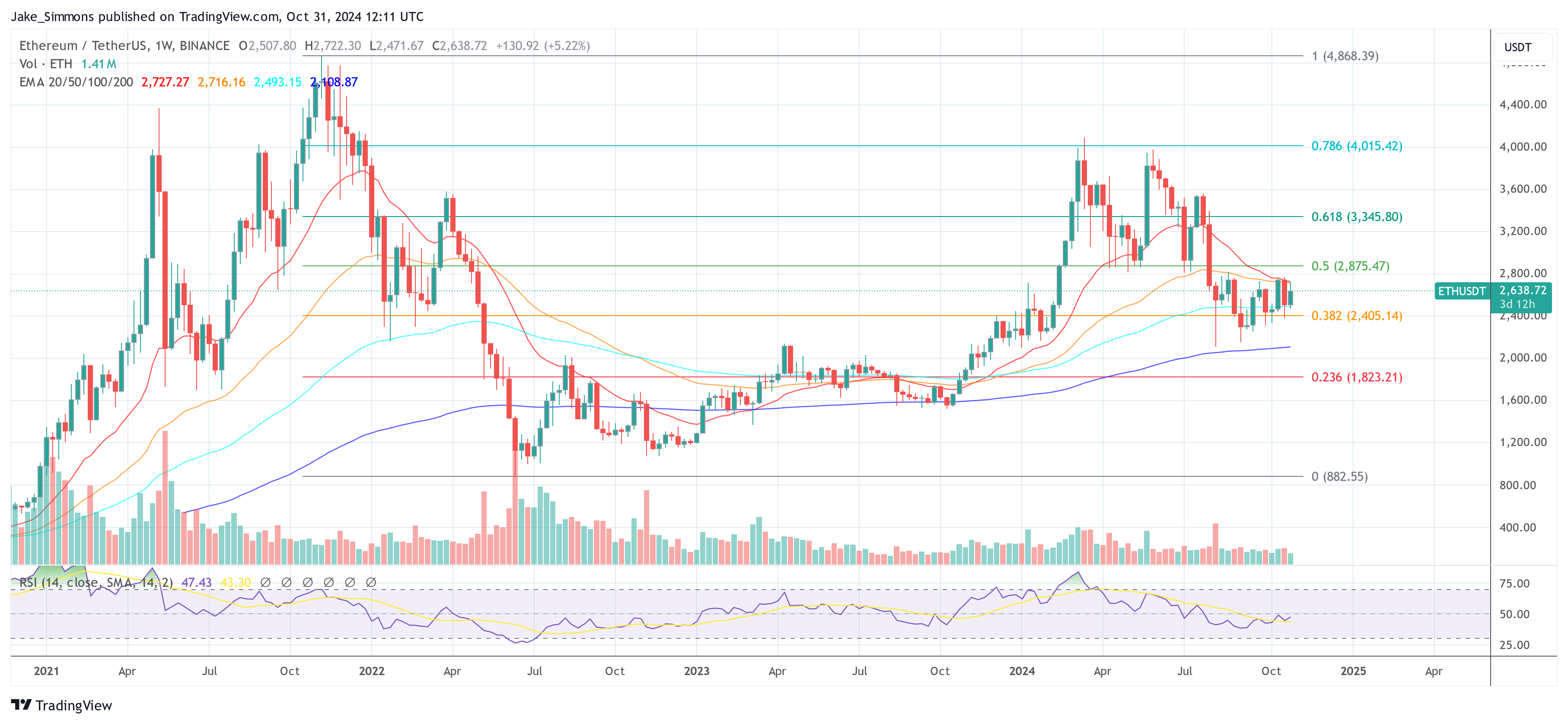

At press time, ETH traded at $2,638.

Featured image created with DALL.E, chart from TradingView.com