Este artículo también está disponible en español.

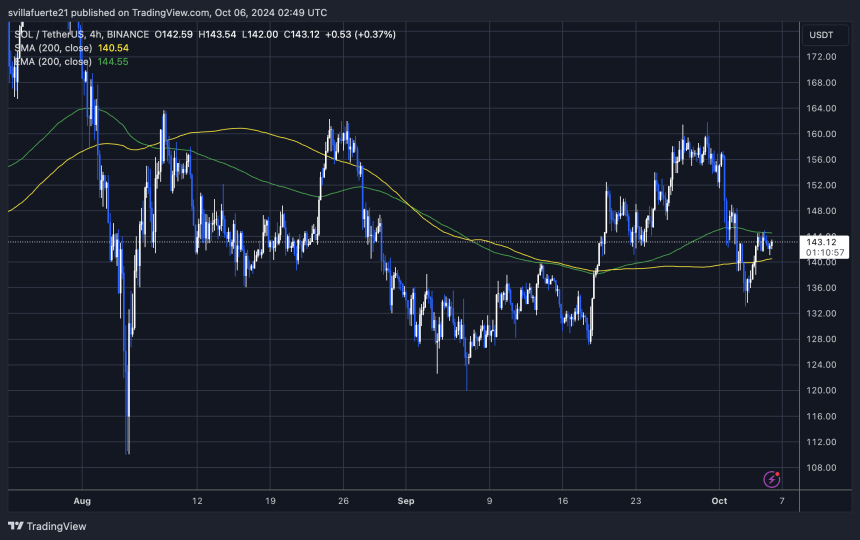

Following its brief stint above $66,000, the Bitcoin price fall had put it below multiple important levels. This allowed the bears to thrive as they reclaimed control of the largest cryptocurrency by market cap once again. Even now, as the Bitcoin price looks toward some recovery, the bear camp continue to wax stronger, with a most recent failure to break the MA-200, suggesting that the uptrend may only be temporary and a larger crash could be at play.

Why The Bitcoin Price Failing At MA-200 Is Bad

Crypto analyst RLinda revealed in a TradingView post that the Bitcoin price had actually tried to break the M1-200 level. This attempt took place on the daily chart with the price moving toward the $64,000-$65,000 resistance. However, the resistance at $64,000 proved too strong and the Bitcoin price was beaten down once again.

Related Reading

The product of this failure at the daily MA-200 now is that the Bitcoin price is now forming a descending channel. Naturally, this is bearish for the Bitcoin price given that descending channels are often messengers of a crash. Add in the fact that the price has broken a range boundary with a strong liquidity zone formed and the crypto analyst believes that the market could be headed further down.

Since the bears remain in control, it seems to be a matter of when, not if, the Bitcoin price will retrace again. After this, the question of how low the price can go swims to the fore and the crypto analyst is currently looking at an at least 10% fall, which would push the price out of $60,000 again.

The main resistance levels presented by the crypto analyst are $62,745 and $64,955. This means that this are the levels the Bitcoin price must successfully scale in order to confirm the uptrend. In comparison, RLinda puts support levels at $60,000, $59,250, and $57,700. If the BTC price is unable to sustain these levels, then the dip could be deeper than expected, possibly crashing as low as $52,000.

How To Weaken The Bearish Pressure

Another analyst who has highlighted the Bitcoin price failure to break the MA-200 is Alan Santana. He explains in his post that the fact that the cryptocurrency is now trading below this MA-200 has strengthened the bearish bias with a drop expected to follow.

Related Reading

However, there are a couple of developments that could help to weaken the mounting bearish pressure. The first of these is if the Bitcoin price were able to close above $66,500 on the weekly chart. The second is if BTC is able to complete a monthly close above $71,000.

Both of these scenarios would work to invalidate the bearish pressure that is currently mounting on the Bitcoin price. “As long as Bitcoin trades below 66,500 (short-term) or below 71,000 (long-term), the bearish bias remains intact,” the crypto analyst warned.

Featured image created with Dall.E, chart from Tradingview.com