Este artículo también está disponible en español.

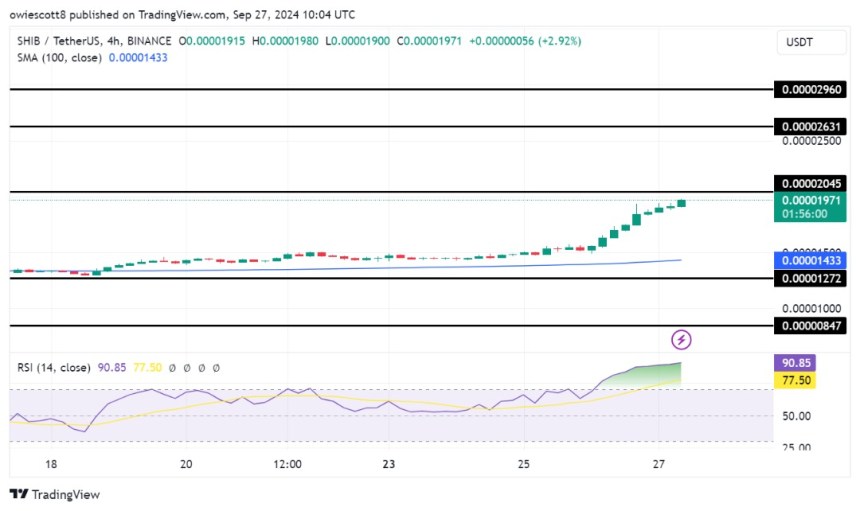

Ethereum’s movement last week was full of mixed signals as Spot Ethereum ETFs started to witness good inflows. Notably, ETH has been on a rally since the middle of September, reflecting a 25% gain from the September 6 low of $2,171 as it crossed $2,715 on September 27.

Related Reading

This rally and the well-anticipated inflows in Spot Ethereum ETFs brought a much-needed breather into the Ethereum ecosystem. According to on-chain data, last week’s price action saw many Ethereum addresses moving into the profitability zone. Particularly, last week’s rally pushed Ethereum’s profitability from 59% of addresses to 69%.

Ethereum Addresses See Much-Needed Profitability

After enduring weeks of market consolidation and outflows from Spot Ethereum ETFs, Ethereum’s price began an upward trajectory in the middle of September that has reignited investor interest. According to data shared by on-chain analytics platform IntoTheBlock (ITB), the rally has led to more than two-thirds of Ethereum holders being in profit.

The key to understanding this development lies in ITB’s “In/Out of the Money” metric, which plays a crucial role in assessing the profitability of cryptocurrency holders. This metric compares the current market price of Ethereum to the purchase prices recorded for addresses that hold the asset.

By doing so, it calculates which holders are in profit, in loss, or at the break-even point (known as “at the money”). According to this measure, Ethereum has reached its highest profitability levels in nearly two months, a significant indicator of growing bullish sentiment.

The graph below shows that the number of Ethereum addresses in profit reached 85.03 million last week, representing 69.38% of the total Ethereum addresses. At this time, Ethereum was trading at $2,693. Furthermore, the data highlights that at this time, 2.61 million ETH addresses were at the money (neither in loss nor profit), while 34.94 million ETH addresses were in losses.

ETH Profitability To Keep Rising?

ETH Profitability To Keep Rising?

Looking ahead, it is only natural to wonder if the profitability will continue to increase in October. Fortunately, the crypto industry is now reveling in bullish sentiment, especially in light of the recent Fed rate cuts and weakening currencies in some parts of the world.

Related Reading

According to IntoTheBlock’s social media handle on X, over 80% of ETH volume is now profitable, indicating strong buying support at critical levels. With bullish projections now falling in place, we could see many more addresses and ETH easily crossing into profitability next week.

As Ethereum pushes toward higher price levels, the focus will also turn to key psychological barriers, such as the $3,000 mark. The first step for ETH bulls is to make a clean break above $2,700 next week. This would set the stage for a successful run to $3,000, bringing even more addresses back into profit.

Featured image from Stormgain, chart from TradingView