The US-based spot Ethereum ETFs have continued to experience a high market interest following Donald Trump’s emergence as the next US President. As institutional investors continue to position themselves for a massive crypto bull run, these Ethereum ETFs have now registered over $500 million in weekly inflows for the first time since their trading debut in July. Meanwhile, the spot Bitcoin ETFs maintain a splendid performance, closing another week with over $1 billion in inflows.

Spot Ethereum ETFs Notch Up $515M Inflows To Extend 3-Week Streak

According to data from ETF aggregator site SoSoValue, the spot Ethereum ETFs attracted $515.17 million between November 9-November 15 to establish a new record weekly inflows, as they achieved a 3-week positive inflow streak for the first time ever. During this period, these funds also registered their largest daily inflows ever, recording $295.48 million in investments on November 11.

Of the total market gains in the specified trading week, $287.06 million were directed to BlackRock’s ETHA, allowing the billion-dollar ETF to strengthen its market grip with $1.72 billion in cumulative net inflow.

Meanwhile, Fidelity’s FETH remained a strong market favorite with $197.75 million in inflows, as its net assets climbed to $764.68 million. Grayscale’s ETH and Bitwise’s ETHW also accounted for weighty investments valued at $78.19 million and $45.54 million, respectively.

Other ETFs such as VanEck’s ETHV, Invesco’s QETH, and 21 Shares’ CETH experienced some significant inflows but of no more than $3.5 million. With no surprise, Grayscale’s ETHE continues to bleed with $101.02 million recorded in outflows, albeit retains its position as the largest Ethereum ETF with $4.74 billion in AUM.

In general, the total net assets of the spot Ethereum ETFs also decreased by 1.2% to $9.15 billion representing 2.46% of the Ethereum market cap.

Related Reading: Spot Bitcoin ETFs Draw Over $2 Billion Inflows As Ethereum ETFs Turn Green Again – Details

Spot Bitcoin ETFs Remain Buoyant With $1.67B Inflows

In other news, the spot Bitcoin ETFs market recorded $1.67 billion in the past week to continue its stunning performance of Q4 2024. While the Bitcoin ETFs saw notable daily outflows of over $770 million at the week’s end, earlier weighted inflows of $2.43 billion proved quite significant in maintaining the market’s green momentum.

BlackRock’s IBIT, which ranks as the market leader and the best-performing crypto spot ETF, now boasts over $29.28 billion in inflows and $42.89 billion in net assets. Meanwhile, the total net assets of the spot Bitcoin ETF returned to above $95 billion, capturing 5.27% of the Bitcoin market.

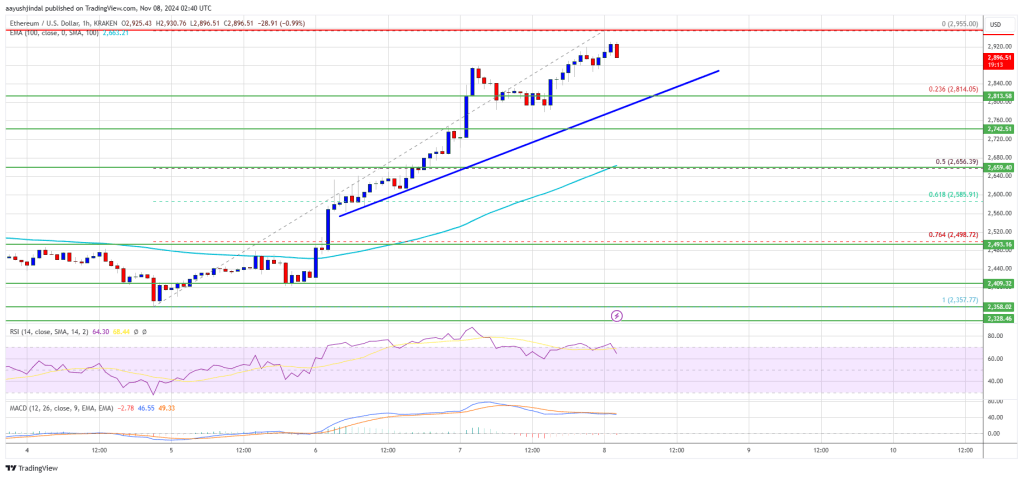

At the time of writing, Bitcoin trades at $90,175 with Ethereum hovering around $3,097.