Este artículo también está disponible en español.

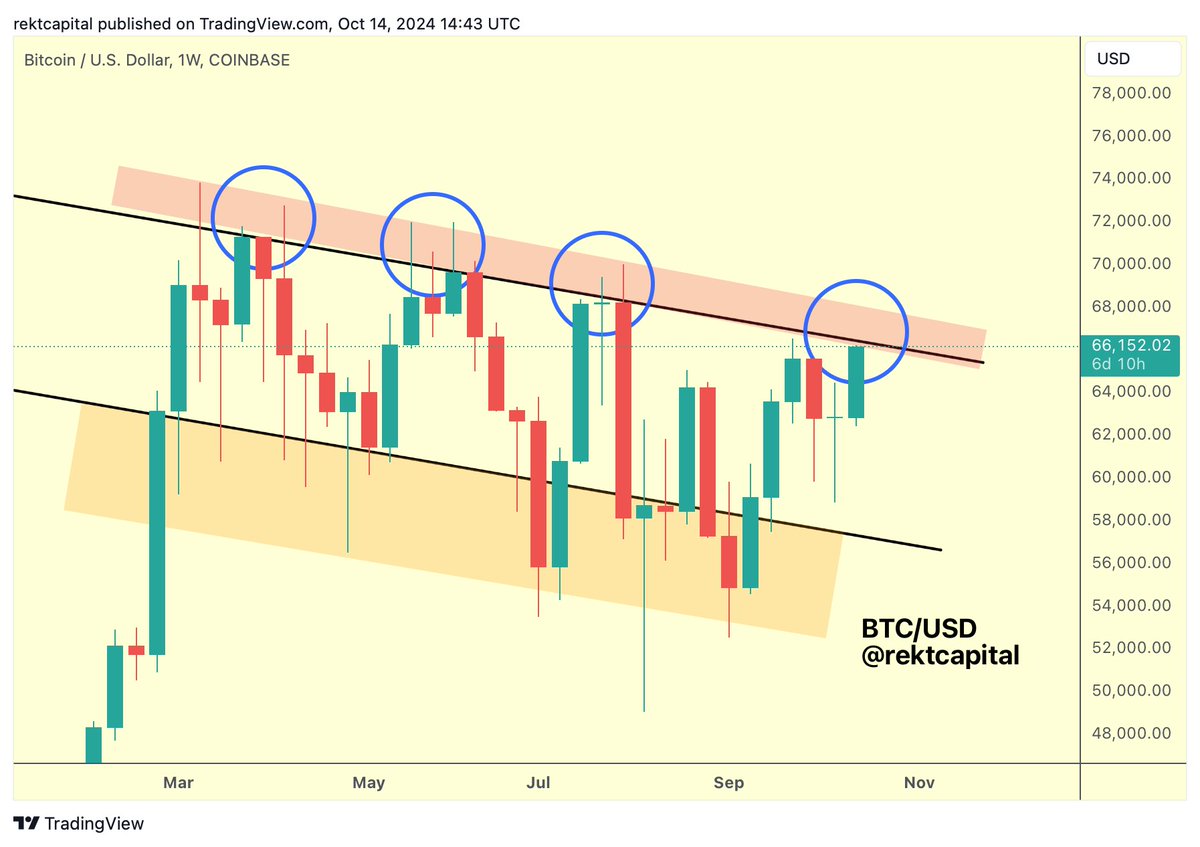

The Bitcoin price has now broken above the $68,000 mark amid a run of a 12% price increase in the past seven days. However, analysis says the Bitcoin price will not stop this surge anytime soon. According to a detailed analysis posted on TradingView, a well-known crypto analyst has shared insights suggesting that Bitcoin is on track to climb even higher to reach an ambitious target of $95,000, but USDT.D needs to break below the lower boundary of a triangle first.

Interesting Take On Bitcoin Price Outlook

The analyst in question, known as TheSignalyst, takes an unconventional approach to analyzing Bitcoin’s price movement by relying on a lesser-known but intriguing metric.

Related Reading

According to TheSignalyst, the USDT.D chart, which tracks the dominance of the stablecoin Tether (USDT) in the cryptocurrency market, efficiently tracks the overall sentiment of the crypto market. Though not widely used by mainstream analysts, this metric has proven useful in predicting market tops, bottoms, and future price action.

According to the USDT.D chart, the USDT dominance has been playing out a descending triangle pattern since the first days of August. Since this period, the USDT dominance has ranged between 6.5% and 5.34% of the total crypto market cap up until the time of writing. As the analyst noted, as long as USDT dominance remains within the descending triangle, Bitcoin’s price is likely to continue consolidating in a range.

However, TheSignalyst adds that for Bitcoin to truly enter a bullish run, the USDT dominance needs to break downward. Specifically, it would have to fall below the lower boundary of the descending triangle and drop beneath 5.2% of the total crypto market cap.

What Does This Mean For The BTC Price?

As the largest stablecoin, the USDT dominance can reveal a lot about the prevailing sentiment among crypto traders. High periods of USDT dominance suggest investors are pulling out of riskier assets and parking their funds in stablecoins, while a decline in the USDT dominance suggests inflows into cryptocurrencies.

Related Reading

In the case of TheSignalyst’s analysis, the USDT dominance breaking below 5.2% would signal reduced reliance on the stablecoin and a renewed appetite for riskier assets, paving the way for Bitcoin to embark on a more aggressive upward trajectory.

According to the analyst, if this scenario unfolds, it could enable Bitcoin’s price to break past the $70,300 mark in the weekly timeframe. This level sits just above a descending trendline that has been stopping Bitcoin’s momentum since April, and a successful breakout could confirm the start of a much larger rally.

In the case of such a breakout, the analyst suggests a strong surge towards the $100,000 price level. At the time of writing, Bitcoin is trading at $68,100 and is about 47% away from this six-figure target.

Featured image created with Dall.E, chart from Tradingview.com